What is a mutual fund?

A mutual fund is a vehicle for collecting funds from investors to be invested in a securities portfolio by an Investment Manager. Securities can include deposits, stocks, bonds, and others.

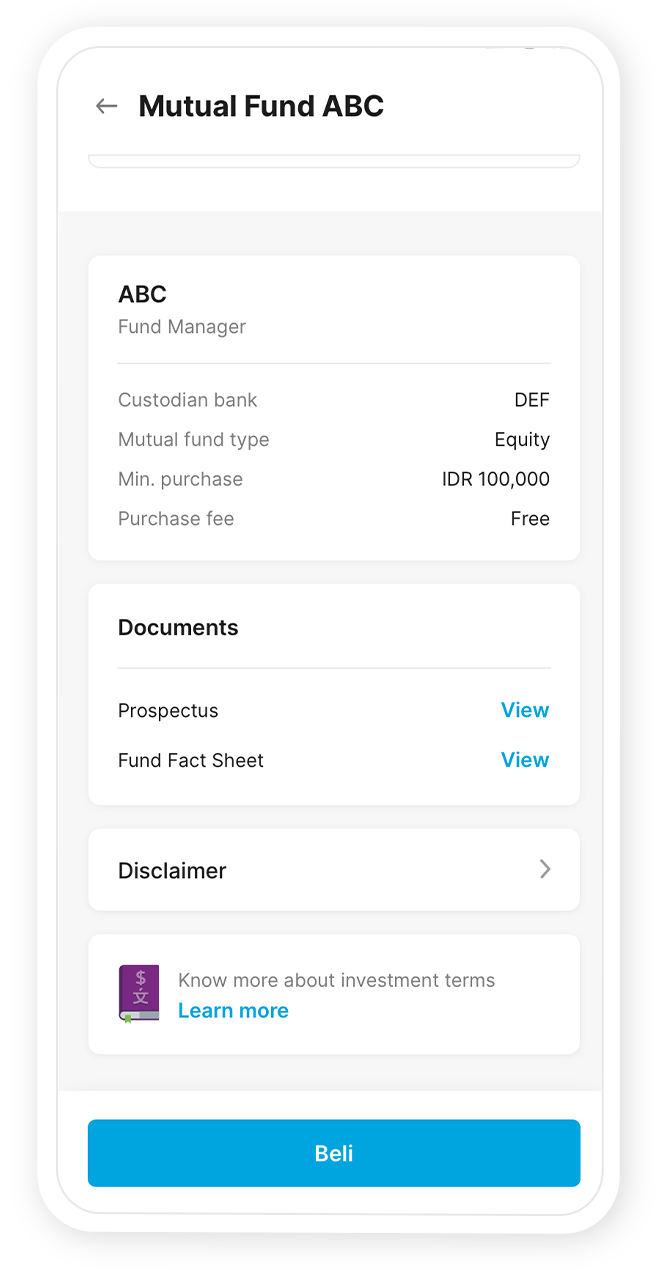

The combination portfolio of these securities will form mutual funds with different proportions and risk levels. Therefore, make sure that you always read and understand the Prospectus and Fund Fact Sheet available before investing in any mutual fund.

What is meant by mutual fund investment in Jenius?

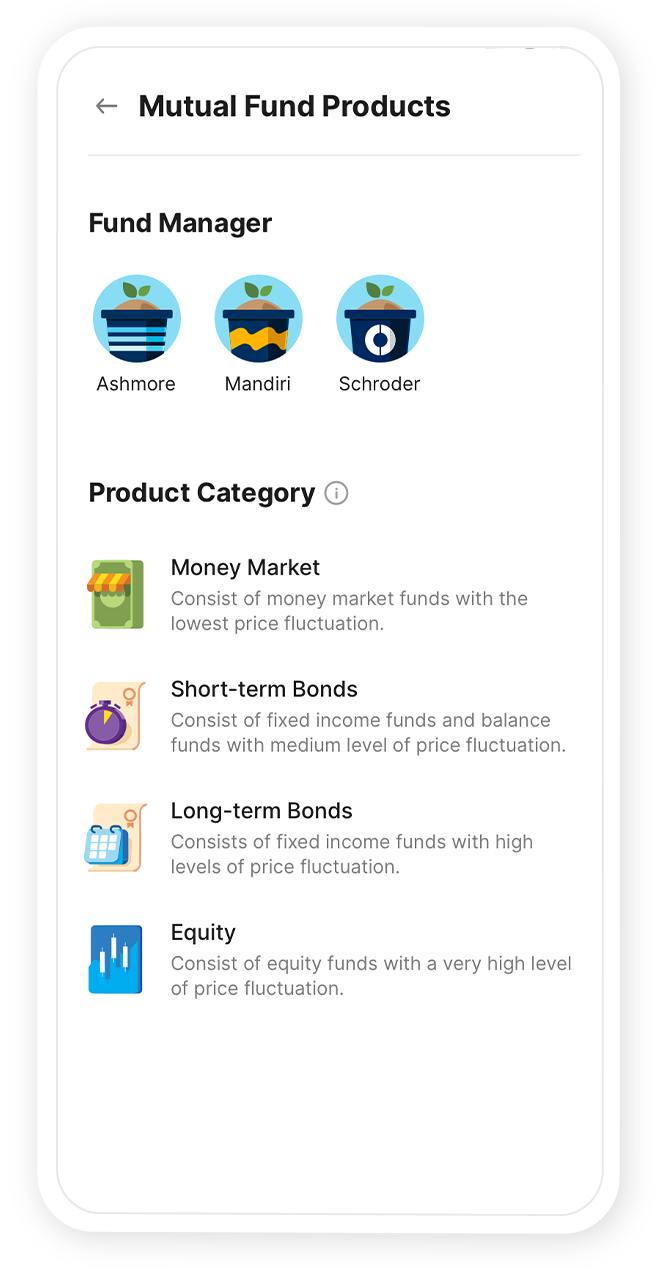

Jenius acts as a Mutual Fund Securities Sales Agent (APERD) that offers products from selected Investment Managers.

Complete information about the mutual fund investment feature in Jenius can be accessed through the following page:

Indonesian:

http://jenius.com/app/investasi/reksadana

English:

http://jenius.com/en/app/investasi/reksadana

Do I need to update the Jenius app to access the mutual fund investment feature in Jenius?

Yes, you need to update the Jenius app to the latest version via Google Play Store or App Store to access the mutual fund investment feature in Jenius.

What do I need to do to transact mutual funds in Jenius?

If you don’t have a Jenius account yet, you need to open one first before you can invest in mutual funds.

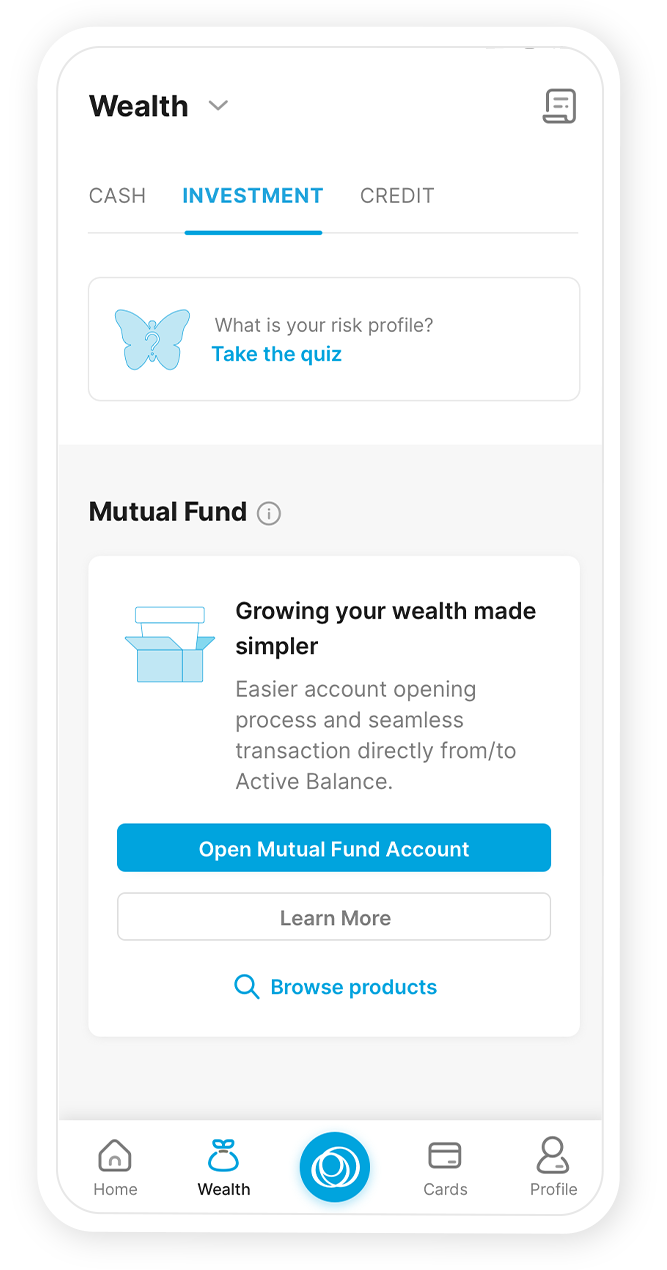

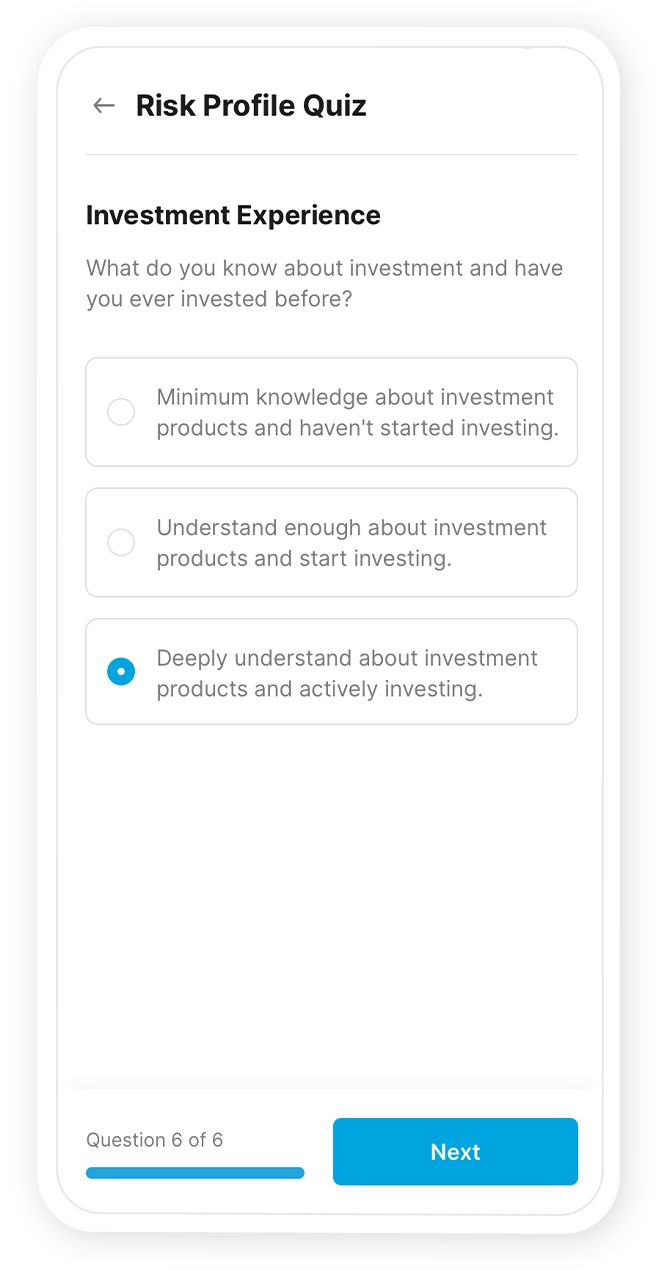

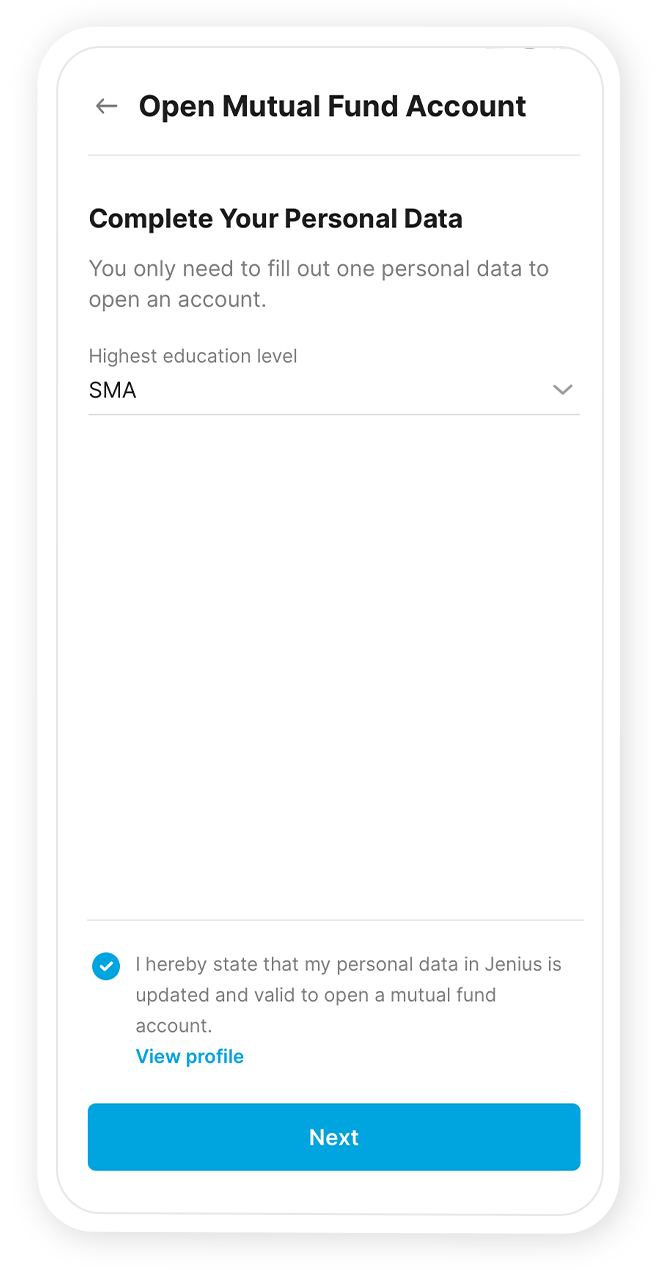

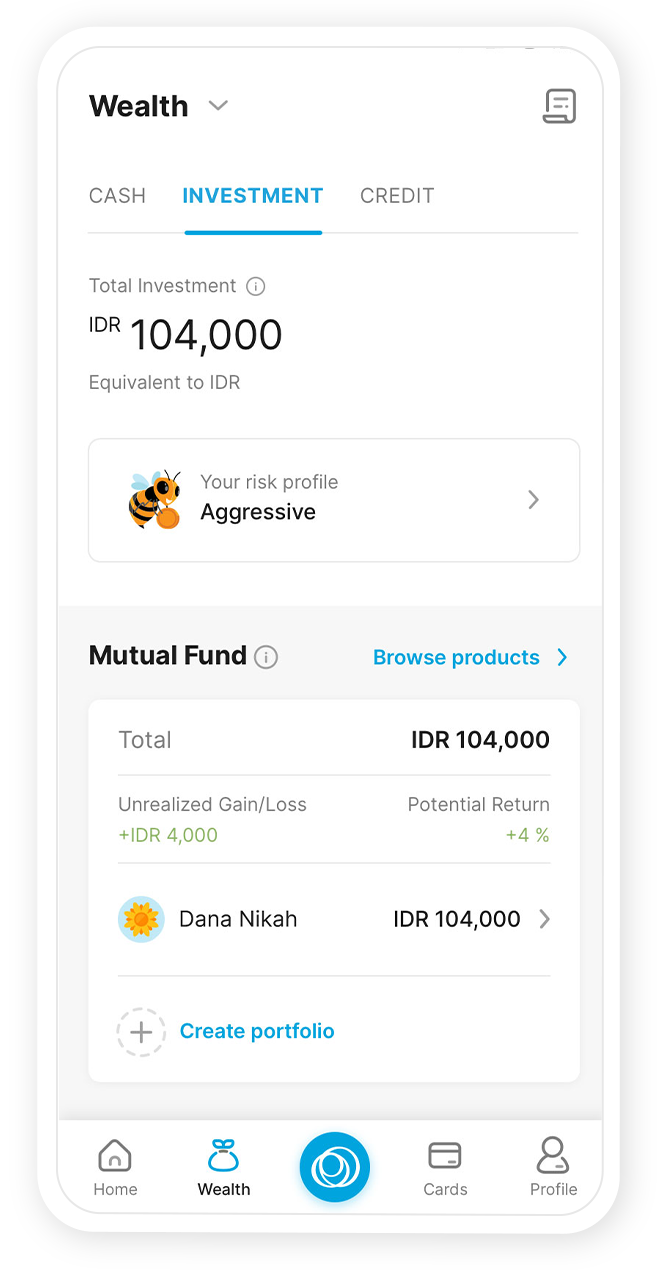

After that, you can select the Wealth menu, answer some questions to determine your risk profile, and complete the investment account opening process on the Jenius app.

Jenius and PT Kustodian Sentral Efek Indonesia (KSEI) will verify all your data. If successful, Jenius will provide a notification that your investment account is active.

What are the benefits of investing in mutual funds in Jenius?

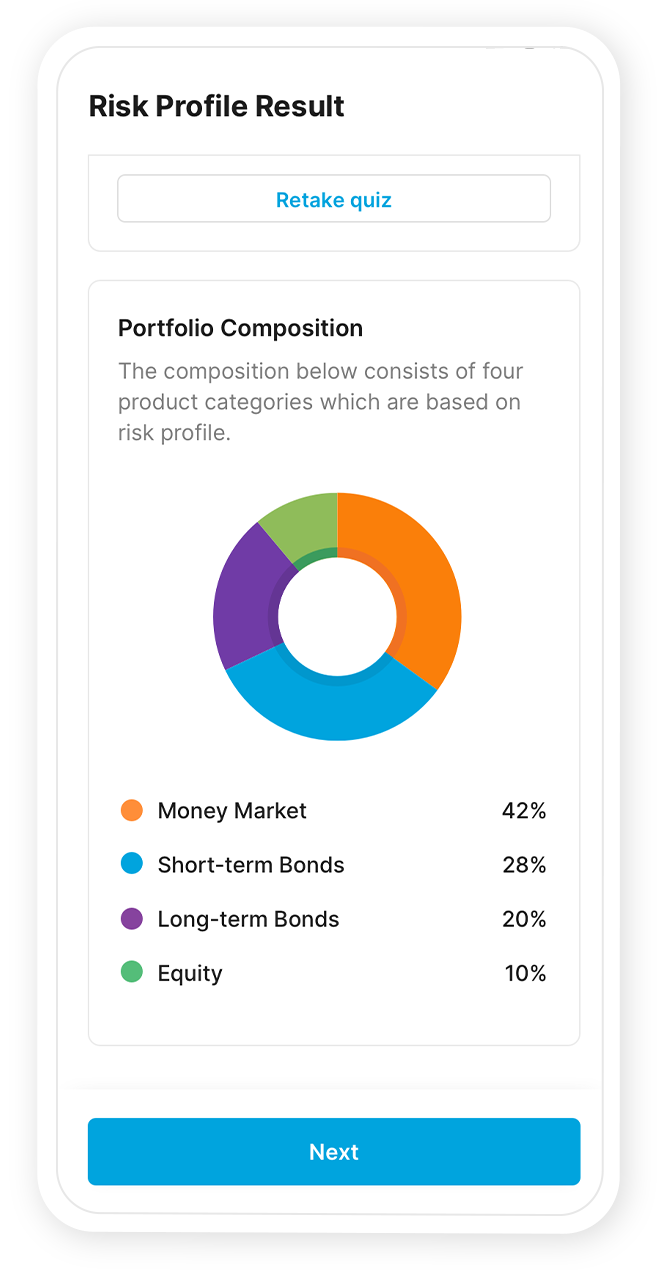

Through the Jenius app, you can access quality mutual fund products from selected investment managers. Jenius also provides investment allocation based on your risk profile to optimize your investments.

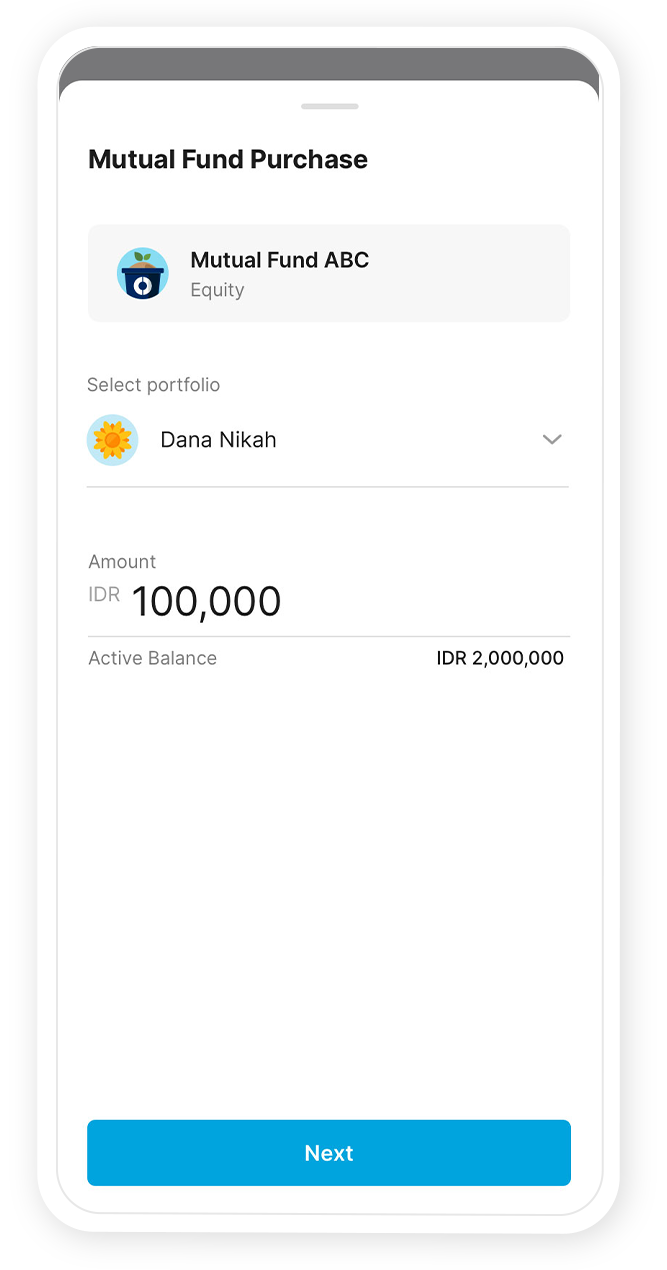

In addition, you can also transact more easily because you only need to transfer funds from Active Balance without switching apps.

Complete information about the mutual fund investment feature in Jenius can be accessed through the following page:

Indonesian:

http://jenius.com/app/investasi/reksadana

English:

http://jenius.com/en/app/investasi/reksadana

What is the difference between mutual funds and time deposits?

The main differences between mutual funds and deposits can be observed from the manager, money storage, initial capital, returns, taxes, and risks.

Manager — Deposit funds are managed by banks to be distributed as credit to other customers. Meanwhile, mutual fund money is managed by investment managers and invested in various instruments such as stocks, bonds, and money markets.

Money storage — When taking deposits, your money will be stored in the bank. All money returns depend on the health of that bank. When buying mutual funds, your money is placed in various investments.

Initial capital — Depending on bank policy, initial deposit amounts range from IDR500,000 to IDR10,000,000. Meanwhile, mutual fund investments are more affordable with minimum purchases starting from IDR10,000.

Returns — Banks determine interest rates from the beginning when you open a deposit account. The interest you receive will always remain fixed according to the initial account opening agreement. This is very different from mutual funds, where returns are determined based on investment manager management. A mutual fund’s performance will be influenced by its investment composition. Therefore, make sure you always read the Prospectus and Fund Fact Sheet to know all important information about the mutual fund you want to buy.

Tax — Banks impose a 20% tax on total deposit returns, while mutual fund investments are not subject to tax. This is based on Income Tax Law article 4 paragraph 3 point i, which explains that mutual funds are not tax objects.

Risk — Deposits have low risk and are guaranteed by the Deposit Insurance Corporation (LPS) up to IDR2 billion. If at any time the deposit-providing bank goes bankrupt, your money will not be lost. Meanwhile, mutual fund products have varying risks, depending on their type. Once again, make sure you always read the Prospectus and Fund Fact Sheet before buying mutual funds to avoid unwanted risks.

Information about the differences between mutual fund products and deposits can be accessed through the following page:

Indonesian:

http://jenius.com/app/investasi/reksadana

English:

http://jenius.com/en/app/investasi/reksadana

Is investing in mutual funds in Jenius guaranteed to be safe?

Yes, Jenius from Bank SMBC Indonesia is supervised by the Financial Services Authority (OJK) and guaranteed by the Deposit Insurance Corporation (LPS).

Your money and mutual funds are safely stored at the Custodian Bank. In addition, Jenius also uses a two-layer security system with the latest technology.

However, if what you mean is security in terms of returns, Jenius cannot guarantee that. Mutual fund investments always contain risks and are entirely the personal responsibility of the investor. Make sure you always read the Prospectus and Fund Fact Sheet of every mutual fund you want to buy.